We are proud to announce that a key scientific publication emerging from the Horizon Europe–funded Invest4Health project has been published in the European Journal of Health Economics.

The article, Broadening sources of finance for health promotion and disease prevention: Smart Capacitating Investment, addresses one of the most persistent challenges in public health today: how to mobilise sufficient, sustainable resources for prevention and health promotion in a context dominated by treatment-focused spending.

This publication represents a major milestone for Invest4Health. It not only advances academic thinking, but also provides practical guidance for policymakers, funders, investors and practitioners who are seeking new ways to invest in healthier societies.

Why prevention still struggles to attract investment

The economic and societal case for prevention is strong. Evidence consistently shows that well-designed preventive interventions can generate substantial long-term returns in terms of improved health, reduced healthcare costs, and stronger economic participation. Yet across Europe, spending on prevention remains strikingly low compared with spending on curative care.

Health systems continue to be largely hospital- and treatment-centric. Nearly half of the burden of non-communicable diseases is linked to preventable environmental, behavioural, metabolic and occupational risk factors, but public expenditure overwhelmingly targets the consequences rather than the causes of ill health. Structural factors make this imbalance difficult to correct: prevention often produces benefits only in the medium to long term, the evidence base can be complex, and savings frequently accrue to sectors other than those that made the original investment.

Against this backdrop, the Invest4Health consortium asked a fundamental question: if conventional public budgets are insufficient, how can we broaden the sources of finance for health promotion and disease prevention without compromising public value?

Introducing Smart Capacitating Investment

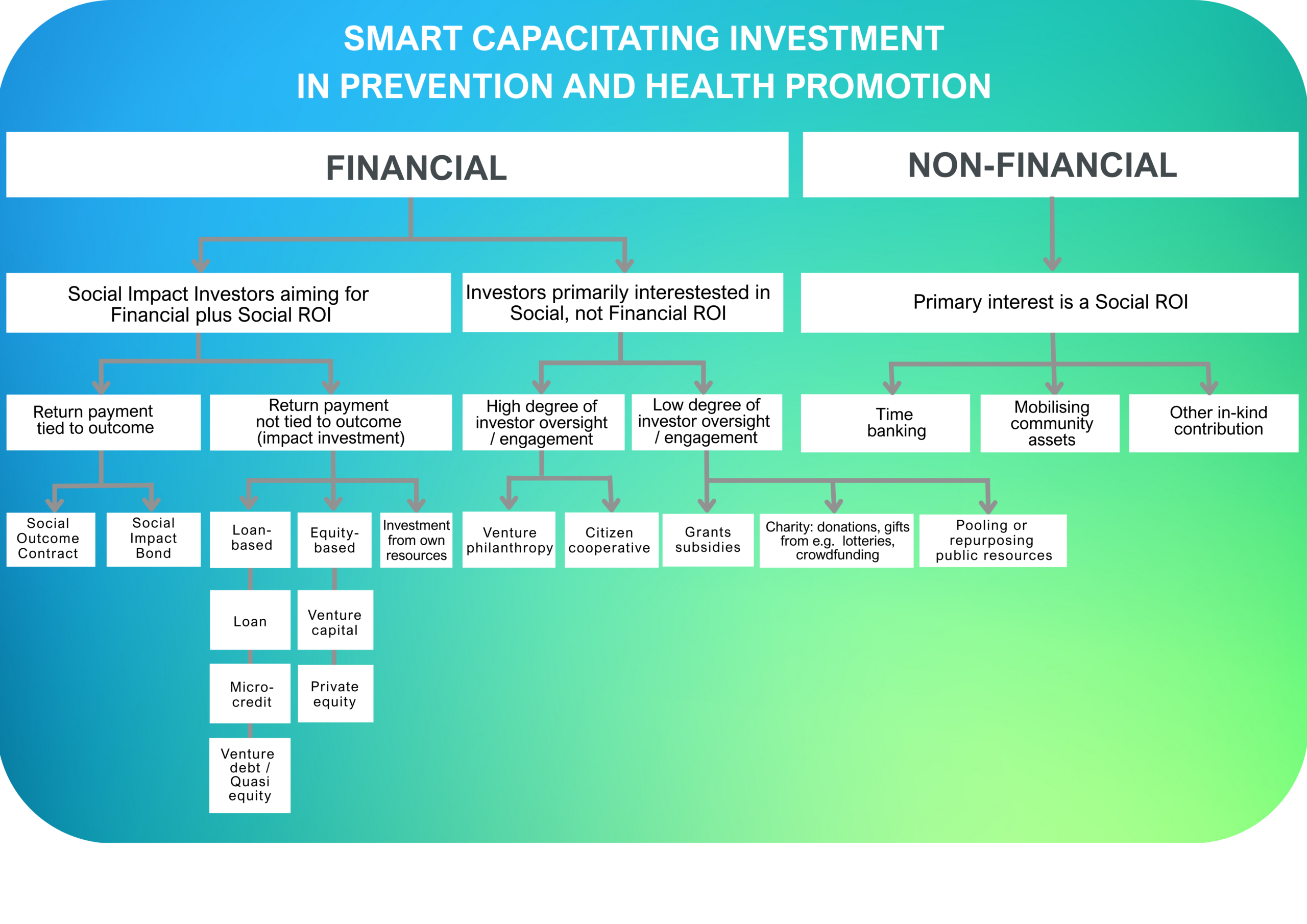

The publication introduces and clarifies the concept of Smart Capacitating Investment (SCI) in the context of health promotion and disease prevention.

SCI refers to unconventional financial and non-financial investments that are designed to strengthen individual and community capacity for healthier behaviours and to address the wider determinants of health. These investments may involve:

- reallocating, pooling or repurposing public funds across sectors or levels of government;

- mobilising private capital through social impact investors, social banks or foundations;

- combining financial investment with non-financial contributions such as time, expertise, infrastructure or community assets.

A defining feature of SCI is that it is capacitating: it seeks not only to deliver short-term outputs, but to build sustainable systems, capabilities and partnerships that support long-term health and well-being.

A comprehensive and innovative research approach

To develop this concept, the authors undertook a rigorous, multi-method research programme as part of Invest4Health. This included:

- a rapid scoping review of both scientific and grey literature covering innovative investment models in health promotion and prevention;

- horizon scanning through expert interviews and targeted web searches of social impact investors and financial institutions;

- a realist-informed synthesis to explore what works, for whom, in which contexts, and why.

In total, nearly 14,000 documents were screened, with 77 studies meeting inclusion criteria for detailed analysis. Sixteen experts from public bodies, investment organisations, consultancies and academia contributed insights through interviews. This combination allowed the authors to move beyond isolated case studies and develop a systematic, evidence-informed understanding of SCI models.

Mapping the landscape of Smart Capacitating Investments

One of the key contributions of the paper is a classification and typology of SCI models. The authors identify a wide range of investment approaches, spanning:

- financial investments seeking both social and financial returns, such as Social Impact Bonds (SIBs), Social Outcome Contracts (SOCs), loan-based and equity-based impact investments;

- investments prioritising social return, including venture philanthropy, charitable funding, grants and pooled public resources;

- non-financial investments, such as mobilising community assets, social prescribing, time banking and in-kind contributions.

These models are mapped across the levels of the prevention pyramid, from population-wide primary prevention to tertiary prevention. The analysis shows that SCIs are already being applied at all levels, but are most commonly used in primary prevention targeting at-risk groups.

Notably, Social Impact Bonds emerged as the most frequently cited model, and the only one found across all levels of prevention. However, the study also highlights the growing importance of blended models, where multiple forms of investment are combined within public–private partnerships.

The central role of government

A striking finding of the research is the indispensable role of government in successful SCI initiatives. Even where private or philanthropic investors are involved, public authorities often act as commissioners, co-investors or conveners.

Governments frequently pool or repurpose budgets across sectors such as health, social care, employment, education or housing to support place-based prevention initiatives. This public involvement helps:

- align investments with policy objectives;

- reduce risk for private investors;

- ensure accountability and evaluation;

- safeguard public value.

The research shows that government backing is often a decisive factor in attracting private capital, particularly in complex or innovative prevention projects.

What motivates investors – and what holds them back

The realist-informed synthesis sheds light on investor motivations, barriers and enablers.

Public commissioners are typically driven by policy goals and long-term cost containment, rather than direct financial returns. Private and social impact investors often seek a mix of social impact and financial return, with outcome-based models such as SIBs offering a way to share risk and test innovative approaches.

Philanthropic actors and venture philanthropists prioritise social outcomes and are often willing to absorb higher risk, particularly in early-stage or experimental initiatives.

At the same time, significant barriers remain. These include:

- high transaction costs, especially for SIBs and SOCs;

- complex and bespoke contracts;

- challenges in defining measurable outcomes and credible counterfactuals;

- the “wrong pocket” problem, where benefits accrue to actors other than the initial investor;

- limited availability of robust evidence on long-term outcomes and cost-effectiveness.

Enablers for successful and scalable SCI

The study also identifies key enablers that can increase the likelihood of success and scalability:

- long-term investment horizons that match the nature of prevention;

- shared missions and collective impact frameworks across sectors;

- early and sustained stakeholder engagement;

- strong intermediaries to manage complexity and build trust;

- credible evaluation strategies that combine short-, medium- and long-term outcomes;

- supportive EU-level institutions that can de-risk investments and catalyse innovation.

Importantly, the authors argue that prevention must be treated as an investment rather than a cost, both in financial decision-making and in public budgeting processes.

A timely contribution to European policy debates

The publication arrives at a moment of growing momentum for prevention at European level. Recent developments, such as the EU’s New Economic Governance Framework, increasingly recognise that investments in health and prevention contribute to economic resilience, productivity and social cohesion.

By providing a clear conceptual framework, a shared language and practical tools, this paper strengthens the evidence base needed to justify and guide smarter investments in prevention.

Why this publication matters

This article is more than an academic contribution. It is:

- a conceptual milestone in defining Smart Capacitating Investment for health;

- a practical resource for designing, commissioning and evaluating innovative financing models;

- a strategic output of the Invest4Health project, reinforcing its ambition to shift thinking and practice across Europe.

As many SCI models are still pilots, the authors emphasise the need for rigorous evaluation and learning. However, the message is clear: Smart Capacitating Investments have real potential to mobilise new resources for prevention, especially when backed by strong public leadership and cross-sector collaboration.

We invite policymakers, funders, investors, researchers and practitioners to engage with this publication and join the conversation on how we can finance healthier futures more effectively.